A Guide to Building Your CRM Sales Pipeline

Transform your sales process with this guide to the CRM sales pipeline. Learn to build, manage, and optimize your pipeline for predictable revenue growth.

Published on February 7, 2026

Think of a CRM sales pipeline as the ultimate roadmap for your sales process. It’s a simple, visual way to see exactly where every potential customer is on their journey to becoming a paying client. It takes all the messy, abstract parts of selling and turns them into a clear, step-by-step game plan.

Your Revenue Roadmap, Made Visible

Trying to grow revenue without a defined sales process is like driving cross-country without a map. You might get there eventually, but you'll waste a ton of gas, take a bunch of wrong turns, and probably want to pull your hair out.

A CRM sales pipeline is that map. It lays out every single stop from "just browsing" to "deal won," giving your team a structured guide to follow.

This isn’t just a fancy to-do list. It’s a living blueprint for your entire revenue engine. It acts as a single source of truth, showing you how many deals are in play, which stage they’re in, and exactly what needs to happen next to push them over the finish line.

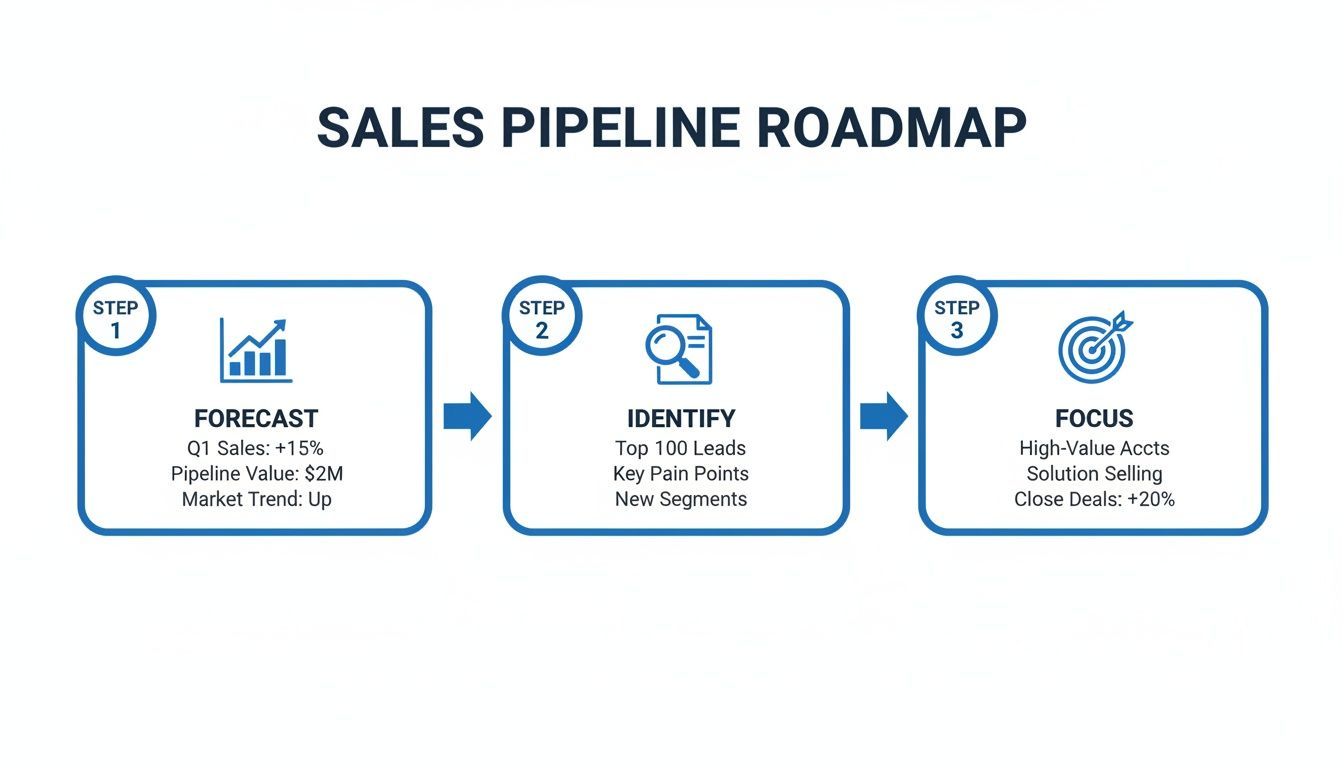

From Guesswork to Predictable Growth

Without this kind of structure, sales teams are basically flying blind. They operate on gut feelings, spreadsheets, and sticky notes. Critical follow-ups get forgotten, hot leads go cold, and managers have no real way to know what next month's numbers will look like.

A pipeline changes all that by turning sales from an art into a science—a clear, repeatable process that actually works.

A well-managed sales pipeline is the single most important tool for forecasting revenue. It lets you see what’s coming, spot problems before they blow up your quarter, and focus your energy on the deals that matter most.

When you build this process inside a CRM, you unlock its true power. Everyone on the team works from the same playbook, giving you an unparalleled view of what’s working, what isn’t, and where the bottlenecks are.

The Driving Force Behind Modern Sales

The entire sales world is moving in this direction. The global CRM software market was valued at around $75.1 billion USD in 2023 and is expected to rocket to $248.2 billion USD by 2033. Why? Because as the amount of customer data explodes, managing a pipeline is the only sane way to keep up. You can dig into more stats about the booming CRM market on BigContacts.com.

A solid pipeline gives your team superpowers:

- Accurate Forecasting: See the value of deals in each stage and their probability of closing, so you can predict future revenue with confidence instead of just crossing your fingers.

- Smarter Prioritization: Reps can immediately see which leads are hot and which are not, helping them focus their time on opportunities that are actually likely to convert.

- Bottleneck Identification: Easily spot where deals are getting stuck. Are prospects ghosting you after the demo? Is negotiation taking forever? The pipeline shows you exactly where to fix your process.

- Clear Accountability: With defined stages and next steps, everyone knows what they’re responsible for. It creates a culture of ownership where results speak for themselves.

At the end of the day, a CRM sales pipeline organizes the chaos. It transforms random sales activities into a coordinated, predictable engine for growth, making sure no opportunity ever slips through the cracks again.

Building the Core Stages of Your Sales Pipeline

A truly effective CRM sales pipeline is much more than a messy list of deals. Think of it as a structured journey that mirrors how your customer actually makes decisions. Each stage represents a critical milestone—a point where the buyer shows more commitment, and you get the info you need to push the deal forward.

Without these defined stages, your pipeline isn't a strategic roadmap; it's just a cluttered to-do list.

The goal isn't to invent dozens of complicated steps. It’s about establishing a handful of clear, meaningful phases that bring order to your sales process. For most B2B teams, this boils down to 5-7 core stages that shepherd a deal from a cold outreach to a signed contract. The secret sauce? Each stage needs firm entry and exit criteria. This ensures every opportunity is properly vetted before it moves on.

This approach transforms your pipeline from a simple contact list into a system for strategic focus, helping you forecast revenue, zero in on the best opportunities, and concentrate your efforts where they'll pay off.

To make this concrete, here’s a look at the five most common stages you’ll find in a B2B sales pipeline, from that first flicker of interest to the final handshake.

Stage 1: Prospecting

This is the very top of your funnel, where potential deals are first unearthed. Your Sales Development Reps (SDRs) are on the front lines, actively hunting for companies and contacts that match your Ideal Customer Profile (ICP). The work here is all about research, cold outreach, and that initial spark of engagement to see if there's any interest.

An opportunity officially lands in this stage the moment a contact is identified and the first outreach is sent. It stays put until a real, two-way conversation starts. The only goal here is to get a reply and start a dialogue.

Stage 2: Qualification

Once a prospect responds with even a hint of interest, the deal graduates to Qualification. This is arguably the most important phase in the entire pipeline. Why? Because its sole purpose is to determine if this opportunity is actually worth your time.

Companies that nail this part of their sales process see 18% faster revenue growth simply because they’re ruthless about disqualifying poor-fit leads early on. Your salesperson's job here is to become a detective, using a framework like BANT (Budget, Authority, Need, Timeline) to get the facts.

- Entry Criteria: The prospect has replied and agreed to a quick chat.

- Exit Criteria: You’ve confirmed they have a real business pain you can solve, they're the decision-maker (or can get you to them), and they have a rough idea of budget and timing. If a deal doesn't tick these boxes, it’s disqualified. Simple as that.

Defining strict exit criteria for each stage is non-negotiable. It’s what separates a healthy, predictable pipeline from a bloated, unreliable one. It keeps your team focused on real opportunities and makes forecasting far more accurate.

Stage 3: Discovery Call

With a qualified opportunity in hand, it's time to schedule a proper discovery call or demo. In this stage, you’re diving deep into the prospect's challenges, goals, and current setup. This isn't about pitching your product—it's about listening and diagnosing their specific pain points.

The main event is a structured conversation where you ask smart, targeted questions to truly understand their world. A great discovery call solidifies your understanding and gets their buy-in to see a formal proposal. The stage is complete once you have a 360-degree view of their problem and they've agreed to move forward.

Stage 4: Proposal or Solution Presentation

Now that you're an expert on the prospect's needs, you can present a tailored solution. This stage involves creating and sending a formal proposal, a price quote, or delivering a customized product demo that speaks directly to the challenges you uncovered during discovery.

Personalization is everything here. A generic, one-size-fits-all proposal will fall completely flat. This stage ends once the prospect has reviewed your solution, agrees with the approach and pricing in principle, and is ready to talk final terms. To see how these documents are typically structured, you can explore this detailed sales pipeline format.

Stage 5: Closing

This is the final hurdle. All your efforts now are laser-focused on one thing: getting the contract signed. Activities here include handling last-minute objections, negotiating terms, and chasing down final approvals from every stakeholder on their side.

Success in the closing stage hinges on maintaining momentum and making it incredibly easy for the buyer to say "yes." The deal officially exits the pipeline when it's marked as either "Closed Won" (the contract is signed) or "Closed Lost" (they went with a competitor or decided not to buy).

Sample B2B Sales Pipeline Stages and Definitions

To help you get started, we've put together a template outlining these common stages. Use this as a foundation, but don't be afraid to tweak the names, definitions, and criteria to perfectly match your own sales motion. The key is that everyone on your team agrees on what each stage means.

| Stage Name | Description & Key Activities | Exit Criteria (Move to Next Stage) |

|---|---|---|

| Prospecting | Identifying and researching potential customers who fit the Ideal Customer Profile (ICP). SDRs conduct cold outreach via email, phone, and social media. | A prospect responds to outreach and agrees to an initial conversation or meeting. |

| Qualification | The first real conversation happens here. The rep's goal is to qualify the lead using a framework like BANT to confirm there's a legitimate opportunity. | The prospect has a clear need, budget, authority to buy, and a timeline. They are a good fit for the product/service. |

| Discovery Call | A deeper, scheduled meeting where the sales rep diagnoses the prospect's specific pain points, challenges, and goals in detail. | You have a comprehensive understanding of their problem, and they agree your solution is a potential fit and want to see a proposal. |

| Proposal/Demo | Presenting a tailored solution that directly addresses the needs uncovered in discovery. This can be a formal proposal, a price quote, or a live demo. | The prospect has reviewed the proposal/demo and agrees in principle to the proposed solution and pricing. |

| Closing | The final steps to get the deal signed. This includes final negotiations, handling objections, and getting all necessary approvals and signatures. | The contract is signed (Closed Won) or the deal is lost to a competitor or inaction (Closed Lost). |

Having a clearly defined pipeline like this one removes ambiguity and empowers your entire team to speak the same language. It’s the first step toward building a predictable and scalable revenue engine.

Key Metrics That Reveal Your Pipeline's Health

Having a well-defined CRM sales pipeline is a great start, but if you're not tracking the right metrics, you're flying blind. Key performance indicators (KPIs) are what transform your pipeline from a simple deal tracker into a powerful diagnostic tool. Think of it as a health check for your revenue engine—it shows you what’s working, what's broken, and where to focus your attention.

These numbers tell a story. They help you spot underlying problems, like unqualified leads clogging up your early stages or a sluggish sales cycle that's draining profitability. By focusing on the metrics that truly matter, you can turn raw data into a clear path toward predictable growth.

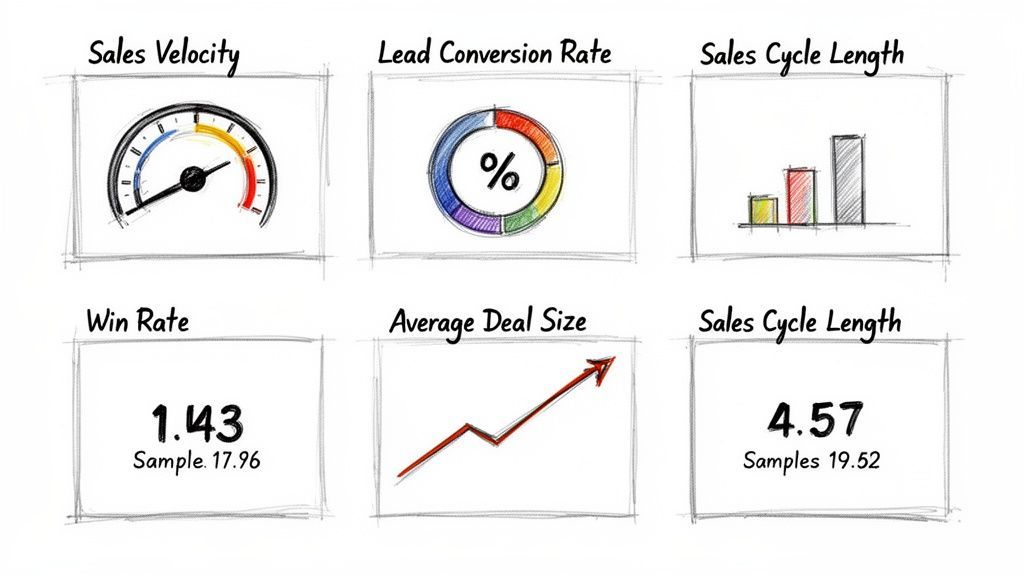

Unlocking Pipeline Performance with Core KPIs

To get a complete picture of your pipeline's health, you need to look beyond just the number of deals you've got cooking. High-performing sales teams consistently monitor a handful of critical metrics that provide a 360-degree view of their entire sales motion.

Here are the five most important ones to track:

Lead Conversion Rate: This shows the percentage of leads that actually make it from one stage to the next. It’s absolutely crucial for identifying bottlenecks in your process. For instance, if you see a high conversion rate from Prospecting to Qualification but a huge drop-off before the Demo stage, you know there's a problem with your initial discovery calls.

Average Deal Size: This is simply the average revenue you bring in from each closed-won deal. Keeping an eye on this helps you understand which types of customers are most valuable and makes your revenue forecasting way more accurate. A declining average deal size might be a red flag that your team is spending too much time on smaller, less profitable accounts.

Win Rate: Calculated by dividing your closed-won deals by the total number of opportunities (both won and lost), your win rate is the ultimate measure of sales effectiveness. It answers a simple question: when we have a real shot, how often do we actually win? A low win rate often points to issues with qualification or how you stack up against the competition.

Digging Deeper with Advanced Metrics

Once you have a handle on the basics, you can start digging into more advanced indicators that connect different parts of your sales process. These metrics give you a much more nuanced understanding of your team's efficiency and momentum.

Your sales pipeline data is more than a record of the past; it's a predictor of the future. The metrics you track today directly influence the strategic decisions you'll make tomorrow, shaping your ability to hit targets consistently.

A perfect example is Sales Cycle Length. This is the average time it takes for a deal to go from the very first touchpoint all the way to a closed sale. A long or lengthening sales cycle can seriously impact your cash flow and productivity. It almost always reveals friction points in your process that need smoothing out. Our guide on sales efficiency metrics dives deeper into how to measure and shrink this number.

The Ultimate Health Indicator: Sales Velocity

If there's one metric to rule them all, it's Sales Velocity. This KPI measures how quickly deals are moving through your pipeline and turning into actual revenue. It cleverly combines four other key metrics into a single, telling number that reflects the overall health and speed of your sales engine.

The formula is: (Number of Opportunities x Average Deal Size x Win Rate) / Sales Cycle Length

A higher sales velocity means you're making more money in less time. It's that simple. If you improve any of the four inputs—by adding more qualified opportunities, increasing deal values, boosting your win rate, or shortening your sales cycle—you will accelerate your revenue growth.

When it comes to pipeline management, one of the most telling stats is the MQL to SQL conversion rate. Top-performing teams see 15-25% conversion here, while the industry average languishes around 6-10%. What's more, sales velocity has been shown to improve by 20% for teams using AI-driven CRMs, which can slash cycle lengths from over 90 days to under 60 in mature pipelines. And when sales and marketing teams are aligned, win rates climb to an average of 28%, compared to just 18% for those that aren't. It's clear proof that these metrics are powerful predictors of revenue.

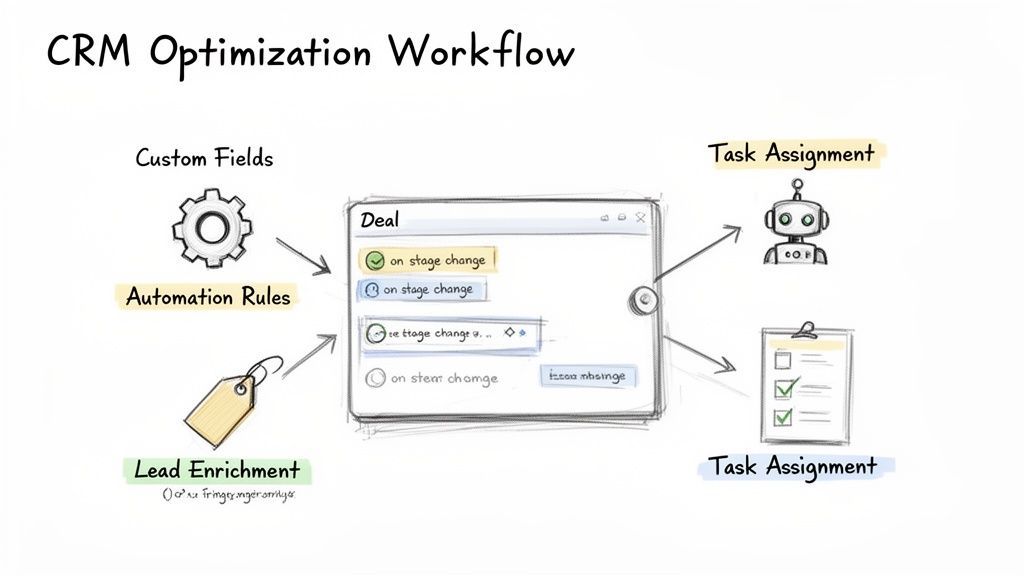

How to Optimize Your Pipeline Inside Your CRM

Building your pipeline stages is like drawing up the architectural blueprint. Optimizing it inside your CRM is where you start laying the bricks and wiring up the electricity. A well-designed pipeline isn't static—it's a dynamic engine that actively helps your team win deals faster by killing friction and manual work.

This is where the real magic happens. By using your CRM's built-in tools, you can transform a simple tracking list into an intelligent, automated workflow. The goal is to make capturing data, moving deals forward, and keeping records clean completely effortless.

And the data backs this up. Companies that properly define and manage their sales process see 18% faster revenue growth than those who don't. Optimization is what unlocks that potential.

Map Custom Fields to Capture What Matters

Every business is different, and the standard fields in your CRM (like name, email, and company) rarely tell the whole story. Custom field mapping is your first and most critical step. It lets you tailor your CRM to grab the specific data points that are vital to your sales process.

For example, you could create custom fields to track:

- Lead Source: Where did this lead really come from? A specific conference, a referral partner, or that new ad campaign?

- Key Pain Point: What's the number one business challenge this prospect is trying to solve? This helps personalize every single follow-up.

- Competitor Mentioned: Are they already using a competitor's product? That information is gold for positioning your solution.

By mapping these fields, you ensure your reps gather the right intel from day one, which makes your entire sales strategy smarter and your forecasting far more accurate.

Automate Workflows to Eliminate Manual Drudgery

Sales automation is no longer a "nice-to-have"—it's essential for any team that wants to scale. Sales reps spend a shocking amount of their day on tasks that have nothing to do with selling. Automation claws that time back by taking repetitive work off their plate.

Think about all the simple, predictable actions that happen every day. Your CRM can handle most of them for you.

A well-configured CRM doesn't just store information; it acts on it. Automation is the bridge between having data and using it to drive momentum, ensuring no deal ever stalls due to human error or forgetfulness.

Here are a few powerful automation workflows you can set up right now:

- Automatic Task Creation: When a deal moves from "Qualification" to "Discovery Call," the CRM can automatically create a task for the rep to "Prepare and send pre-call agenda."

- Lead Rotation: Automatically assign new leads to reps based on territory, industry, or a simple round-robin to ensure fair distribution and lightning-fast follow-up.

- Stale Deal Alerts: If a deal sits in one stage for too long (say, more than 14 days in "Proposal Sent"), the CRM can ping the sales manager to review it.

These small automations add up, freeing your team to focus on building relationships and closing deals instead of getting buried in admin.

Supercharge Your Data with Lead Enrichment

A contact record with just a name and an email is a starting point. A fully enriched record is a competitive advantage. Lead enrichment tools automatically pull in valuable data from public sources to flesh out your prospect profiles, saving countless hours of manual research.

This screenshot shows how a tool can instantly capture and enrich contact info, populating CRM records in a single click.

Instead of your SDRs digging for details like company size, industry, revenue, or a prospect's job title, enrichment tools do it for them in seconds. This means your team can have more informed, relevant conversations right out of the gate. The better your data, the more personalized and effective your outreach will be. You can learn more about how to automate data entry in our comprehensive guide.

By combining custom fields, smart automation, and powerful lead enrichment, you create a CRM sales pipeline that doesn't just track deals—it actively helps you win them. This streamlined process boosts efficiency, improves data quality, and gives your team the tools they need to focus on what they do best: selling.

Using Advanced Reports for Strategic Insights

A well-structured CRM sales pipeline does more than just show you where your deals are; it creates a goldmine of data. But raw data is just noise. The real magic happens when you move past surface-level tracking and start digging into advanced reports. These are the tools that show you the why behind your numbers, turning guesswork into a data-driven strategy.

Think of your pipeline data like an EKG for your sales process. A quick glance tells you if the heart is beating, but a real analysis shows you its rhythm, strength, and any hidden problems. Advanced reports give you that deeper diagnosis, so you can make precise improvements instead of just hoping for the best.

Pipeline Coverage Report

This is one of the most fundamental reports for any sales leader. The Pipeline Coverage Report answers one critical question: "Do we have enough qualified deals in the works to actually hit our quota?"

The math is simple: just divide the total value of all your open opportunities by your revenue target. For example, if your quarterly quota is $200,000 and you have $600,000 in qualified opportunities, your pipeline coverage is 3x. Most sales leaders sleep better at night with a healthy coverage ratio of 3x to 4x. Anything less is a major red flag, signaling that your team needs to drop everything and start prospecting to avoid a shortfall.

Stage Velocity Analysis

Ever feel like your deals just… disappear? The Stage Velocity Analysis report tells you exactly where they get stuck. It measures the average time an opportunity spends in each stage of your pipeline, instantly highlighting the bottlenecks slowing down your entire sales cycle.

Imagine you discover that deals fly through "Qualification" in just 7 days but then sit in "Proposal Sent" for over 30 days. That's a huge insight. It tells you the team is great at qualifying, but something is breaking down after the proposal goes out.

This could mean a few things:

- Your proposals aren't hitting the mark.

- Reps aren't setting clear next steps with prospects.

- You're talking to influencers, not the final decision-makers.

By pinpointing the exact stage where friction happens, you can give targeted coaching and fix the process where it’s actually broken.

Advanced reporting transforms sales management from a reactive exercise into a proactive strategy. Instead of asking "What happened last quarter?" you can start asking "What can we do right now to ensure we hit our goals next quarter?"

Win-Loss Analysis Report

Knowing why you win is great, but knowing why you lose is where the real growth happens. A Win/Loss Analysis Report dives much deeper than a simple win rate. It segments all your closed deals—both won and lost—by factors like competitor, lead source, industry, or deal size.

The strategic insights here are game-changing. Do you consistently lose to a specific competitor on price? Maybe you need to sharpen your value proposition. Are you winning almost every deal from a particular industry? It might be time to double down on that vertical.

Sales pipeline reports are no longer a "nice-to-have." Teams using advanced CRM analytics report 30-50% more accurate forecasts and 25% shorter sales cycles. For instance, win rates for qualified opportunities can hover around 45% but often drop to just 15% without good data. This is why instant, accurate data capture is so critical for pipeline health. You can find more examples of the top sales pipeline reports on Zime.ai.

By regularly reviewing these three reports, you can turn your CRM from a simple database into a strategic command center. You'll be able to forecast revenue more accurately, refine your sales process with surgical precision, and give your team the coaching they need to crush their goals.

Common Questions About CRM Sales Pipelines

Even with a perfectly designed CRM sales pipeline, you're going to have questions. Everyone does. Nailing the details is what separates a pipeline that looks good from one that actually drives revenue.

Think of this as your go-to FAQ for turning a decent pipeline into a great one. Getting these answers right ensures your entire team is operating from the same playbook.

What Is the Difference Between a Sales Pipeline and a Sales Funnel?

This trips up a lot of people, but the distinction is actually pretty simple—and crucial.

A sales funnel is all about the buyer's journey from a marketing point of view. It’s a numbers game, tracking the entire universe of potential leads as they go from vaguely aware to genuinely interested. It might start with 1,000 website visitors that get whittled down to 100 marketing qualified leads (MQLs). It’s broad and theoretical.

A sales pipeline, on the other hand, is all about the seller's process. It’s a focused, actionable map of the specific steps your reps take to move a qualified opportunity toward a closed deal. While the funnel is marketing's tool for generating leads, the pipeline is sales' tool for forecasting revenue and managing active deals.

How Many Stages Should My Sales Pipeline Have?

There's no magic number here. More stages don't automatically make your process better. A simple, fast-moving sale might only need three or four stages. A complex enterprise deal with a dozen stakeholders could easily need seven or eight.

The golden rule is this: each stage must represent a meaningful milestone where the buyer has shown more commitment.

For most B2B teams, five to seven stages is the sweet spot. It gives you enough detail to track what's happening without bogging reps down in admin work. The goal is always clarity, not complexity. If a stage doesn't have crystal-clear entry and exit criteria, it probably shouldn't exist.

What Are the Most Common Mistakes in Pipeline Management?

Three classic mistakes sink sales pipelines more than any others. Ignore them, and you're setting yourself up for bad forecasts, wasted effort, and missed targets.

A pipeline is like a garden; it requires constant tending. Neglecting it allows weeds—dead deals and bad data—to choke out the healthy opportunities you need to grow.

Here are the top three blunders to avoid:

- Running a Deal Graveyard: This is the big one. Reps let dead or stalled deals just sit there, rotting away. This inflates your pipeline value and gives everyone a false sense of security. The fix? Implement a strict hygiene rule, like automatically disqualifying any deal that’s been gathering dust for 30 days without any activity.

- Inconsistent Data Entry: When every rep logs information differently—or not at all—your CRM reports become worthless. Garbage in, garbage out. The fix? Make key fields mandatory for stage progression in your CRM and create a simple, non-negotiable process for logging calls, meetings, and deal updates.

- Vague Stage Criteria: If moving a deal forward is based on a rep’s "gut feeling," you're in trouble. This leads to a pipeline full of wishful thinking, making accurate forecasting totally impossible. The fix? Define and enforce objective, buyer-centric exit criteria for every single stage. No exceptions.

How Can I Improve My Pipeline's Data Quality?

Good data is the lifeblood of a healthy CRM sales pipeline. It’s what makes your forecasts, reports, and big-picture strategy actually reflect reality. Think of it as an ongoing habit, not a one-time project.

Start by making key fields mandatory in your CRM before a deal can be moved to the next stage. It’s a simple change that forces reps to capture the most critical info every single time.

Next, lean on automation for data enrichment. Tools that automatically pull in company and contact details save your reps hours of soul-crushing manual research and slash human error. Your records stay clean and complete from day one.

Finally, use duplicate detection tools and run regular data audits. These systems stop messy, redundant records from cluttering up your CRM in the first place, and a scheduled cleanup keeps your data hygiene top-notch. A consistent focus here pays off everywhere else.

Ready to stop the copy-paste grind and build a cleaner, faster pipeline? Add to CRM eliminates manual data entry by turning any professional profile into a clean CRM record in one click. Save your team hours every week and ensure your data is always accurate. Start for free on https://addtocrm.com.

Start saving time and closing more deals.

Find contact info for your prospects on the #1 business social network and add them to your CRM with 1-click.

Trusted by 1000s of founders, SDRs & more