Lead Scoring: What It Is and How to Prioritize Top Leads

Learn what lead scoring is and how assigning points by profile and behavior helps sales prioritize the hottest prospects and work smarter. Learn more.

Published on February 4, 2026

- What Is Lead Scoring and Why It Matters

- The Two Pillars of Lead Scoring: Fit vs. Interest

- How to Build Your First Lead Scoring Model

- Putting Your Lead Scoring Model to Work in Your CRM

- How to Measure and Refine Your Scoring Model

- Common Lead Scoring Mistakes and How to Avoid Them

- Common Questions About Lead Scoring

Lead scoring is a system that ranks your leads to figure out who’s most likely to buy, and when. Think of it as a priority filter for your sales team, automatically flagging the hottest prospects by assigning points based on who they are and how they’re interacting with your business.

What Is Lead Scoring and Why It Matters

Picture this: your marketing team just handed sales a list of 100 new leads. Without a system, where do they even start? They might begin calling randomly, sinking valuable time into prospects who are just kicking tires or aren't a good fit. This guesswork isn’t just slow; it’s a massive drain on resources and morale.

That’s the exact problem lead scoring solves.

Instead of treating every single lead the same, lead scoring creates a clear pecking order. It works by assigning points to each lead based on their profile and their actions. This simple shift turns your sales process from a manual, gut-feel operation into a smart, data-driven strategy.

From Guesswork to a Calculated Strategy

The core idea is simple: not all leads are created equal. A CTO from a 500-person tech company who just requested a demo is worlds apart from a student who downloaded a whitepaper for a research project. Lead scoring makes that distinction obvious and, more importantly, actionable.

The system pulls from two main types of information:

- Explicit Data (Fit): This is the stuff a lead tells you directly—job title, company size, industry, location. It’s all about how well they match your Ideal Customer Profile (ICP).

- Implicit Data (Interest): This is all about behavior. Did they visit your pricing page? Open your last three emails? Attend a webinar? These actions signal how engaged they really are.

By blending these data points, you get a complete picture of each prospect. A high score shouts “hot lead!”—someone who’s both a great fit and actively looking for a solution. A low score whispers “cold lead,” signaling that they might need more nurturing or could be a poor fit entirely.

A well-designed lead scoring system moves leads out of the nurturing stage faster, helping identify sales-qualified prospects who can move more quickly down the funnel.

The Business Impact of Prioritization

Lead scoring really took off in the early 2000s alongside the first marketing automation platforms, and it completely changed the game. Before that, sales reps wasted countless hours sifting through unqualified names. It’s no wonder that without a system to prioritize, a staggering 79% of marketing leads never turn into sales.

But with dynamic scoring, especially when you enrich it with real-time data, teams can see sales productivity jump by up to 30%.

This process also builds a much-needed bridge between marketing and sales. Marketing can confidently hand over high-scoring leads, knowing they’re pre-vetted and ready for a conversation. This alignment gets both teams rowing in the same direction: closing better deals, faster. You can learn more about this in our guide on how to qualify sales leads.

The Two Pillars of Lead Scoring: Fit vs. Interest

At its core, every great lead scoring model answers two simple questions: Who are they? and What are they doing?

Getting this right means looking at two completely different types of data. Think of them as the twin pillars holding up your entire system. Understanding how they work together is the secret to spotting your best leads with almost psychic accuracy.

Imagine you’re on a dating app. You don't just swipe right on everyone. First, you check their bio, location, and interests to see if they're even a potential match. That’s the first pillar of lead scoring—assessing the fit.

Pillar 1: Fit Data (Do They Match Your Ideal Customer?)

Fit data—sometimes called explicit or demographic data—is all about the hard facts. These are the concrete details that tell you if a lead lines up with your Ideal Customer Profile (ICP). This info rarely changes, and it gives you a quick yes/no on whether a lead is worth pursuing from the get-go.

Why does this matter so much? Because no amount of eager engagement can magically turn a bad-fit lead into a dream customer.

Common examples of fit-based attributes include:

- Job Title or Seniority: A "VP of Marketing" is almost always a better fit for a B2B marketing tool than an "Intern."

- Company Size: If you sell enterprise software, a lead from a company with 500+ employees is a much stronger signal than one from a two-person startup.

- Industry: A cybersecurity firm will naturally prioritize leads from finance or healthcare over leads from the retail industry.

- Location: If your services are limited to North America, a prospect from Europe is, unfortunately, a dead end.

Think of fit data as your non-negotiables. It’s the baseline criteria someone has to meet to even get in the game. It saves your sales team from chasing ghosts.

Pillar 2: Interest Data (Are They Showing Buying Signals?)

Fit tells you if a lead could be a customer. The second pillar—measuring interest—tells you if they want to be one. This is all about behavioral data, which tracks how a lead interacts with your brand. These actions are powerful buying signals.

Back to the dating app analogy: interest is when that perfect match actually messages you, asks smart questions, and suggests meeting for coffee. Their actions prove they’re engaged.

Interest-based scoring adds points for behaviors like:

- Website Activity: Visiting high-intent pages, like your pricing or case study sections, isn't an accident.

- Email Engagement: Consistently opening your emails and clicking links to product features shows they're paying attention.

- Content Consumption: Downloading a buyer's guide or, even better, attending a product webinar.

- Direct Contact: The ultimate signal—requesting a demo or filling out your "Contact Us" form.

These actions are dynamic, painting a real-time picture of a lead's journey. A high behavioral score means they're actively in the market for a solution like yours and are moving closer to a decision.

Bringing It All Together with Negative Scoring

The sharpest lead scoring models don't just add points; they strategically subtract them. This is called negative scoring, and it's your defense against false positives—those leads who look good on paper but are ultimately unqualified.

For instance, someone might visit your pricing page ten times and download three whitepapers, looking like a red-hot lead. But if their job title is "Student" or they keep clicking on your careers page, they’re almost certainly not a buyer.

By assigning negative points for these attributes, you can keep your system honest. A lead from a known competitor or someone who unsubscribes from your emails should also get dinged. This simple act of subtraction keeps your sales team razor-focused on leads with genuine potential to convert.

How to Build Your First Lead Scoring Model

Alright, let's move from theory to action. This is where lead scoring gets really interesting. Building your first model isn’t some complex data science project; it’s about starting with a simple framework that assigns points based on what you already know about your best customers.

The whole process boils down to turning your Ideal Customer Profile (ICP) into a point-based system. This transforms abstract ideas like “good fit” and “high interest” into a concrete number your team can actually use to decide who to call first.

Assigning Points to Attributes and Actions

Think of your lead scoring model like a game. Prospects earn points by showing they’re a great match for your business. The goal is to give higher scores to the attributes and actions that are most likely to lead to a signed contract. A good rule of thumb is to weigh explicit "fit" data more heavily—after all, no amount of engagement can magically turn a bad-fit company into your ideal customer.

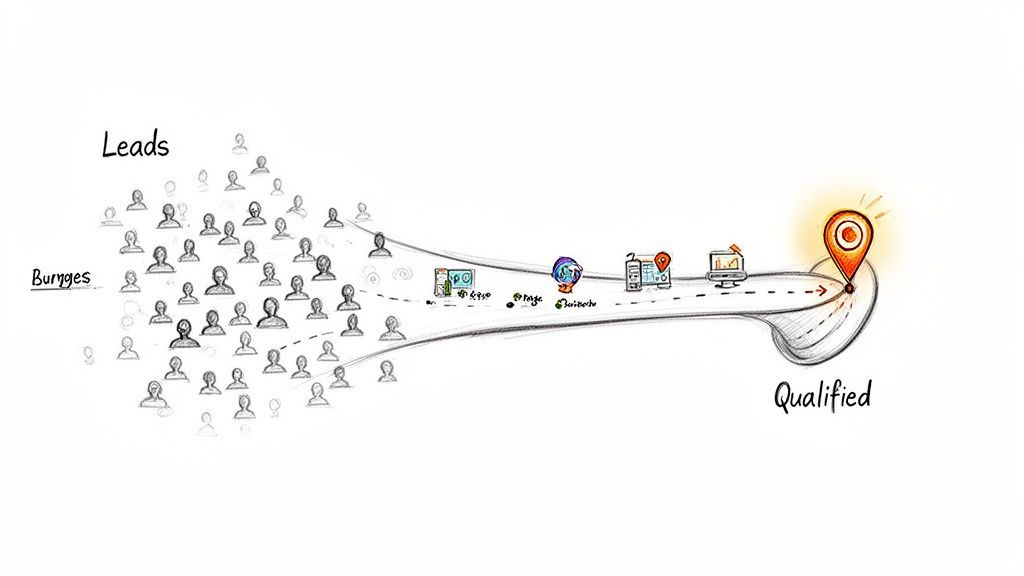

This diagram shows how a lead’s total score is really a combination of two things: their profile fit and their demonstrated interest.

As you can see, a strong lead needs to hit the mark in both categories. They need a solid professional profile that matches your ICP and they need to be actively engaging with your brand.

For example, you might give a big point boost to a lead with a C-level title because your data shows executives are the real decision-makers. On the other hand, an action like downloading a top-of-funnel ebook would earn far fewer points than requesting a product demo—a crystal-clear buying signal.

Remember, your initial point values are a hypothesis. You're creating a solid starting point that you can tweak and refine over time as real performance data rolls in.

Defining Your Lead Scoring Thresholds

Once you have a system for assigning points, the next critical step is setting your lead scoring thresholds. These are the specific point totals that trigger an action—most importantly, the handoff from marketing to sales. A score is just a number without context, and thresholds give it meaning.

You’ll want to create a few distinct tiers to categorize leads by their readiness. This gets both teams on the same page about what to do next.

- Marketing Qualified Lead (MQL): This is your first major milestone. A lead crosses this line when they’ve shown enough interest and fit to be considered a real prospect. They might not be ready for a sales call just yet, but they’re definitely primed for more targeted nurturing from marketing. A common MQL threshold is 50 points.

- Sales Qualified Lead (SQL): This is the magic number. When a lead hits this score, an alert should automatically fire off to the sales team for immediate follow-up. This score screams “high-value prospect” and signals they’re actively engaged and a great fit. An SQL threshold might be set at 100 points or higher.

These thresholds create an automated, objective system for managing your pipeline. When a lead’s score hits 100, there’s no debate—it’s time for a salesperson to connect. This kills the guesswork and ensures your hottest leads never go cold.

A Sample Lead Scoring Template

To make this more concrete, let's look at a practical template showing how to assign positive and negative point values. This table helps you visualize how you might build your own model.

Sample Lead Scoring Point System

Notice how high-intent actions and ideal firmographics get the highest scores, while signals of a poor fit actually deduct points.

| Attribute or Behavior | Description | Sample Score |

|---|---|---|

| Job Title (C-Level) | The lead is a key decision-maker with purchasing authority. | +20 |

| Company Size (50-200) | The company fits squarely within your target market size. | +15 |

| Requested a Demo | The single strongest indicator of purchase intent. | +30 |

| Visited Pricing Page | Shows active consideration of your solution and budget. | +10 |

| Downloaded a Case Study | Demonstrates interest in proven results and solving a specific pain point. | +10 |

| Unsubscribed from Emails | A clear signal of disinterest. | -10 |

| Used a Free Email Domain | Suggests the lead is not associated with a legitimate business (e.g., Gmail). | -5 |

| Visited Careers Page | Indicates the visitor is likely a job seeker, not a potential customer. | -15 |

This simple framework gives you a powerful starting point. By aligning these values with your ICP and customer journey, you’re making sure your model accurately reflects what a high-value lead truly looks like for your business.

Putting Your Lead Scoring Model to Work in Your CRM

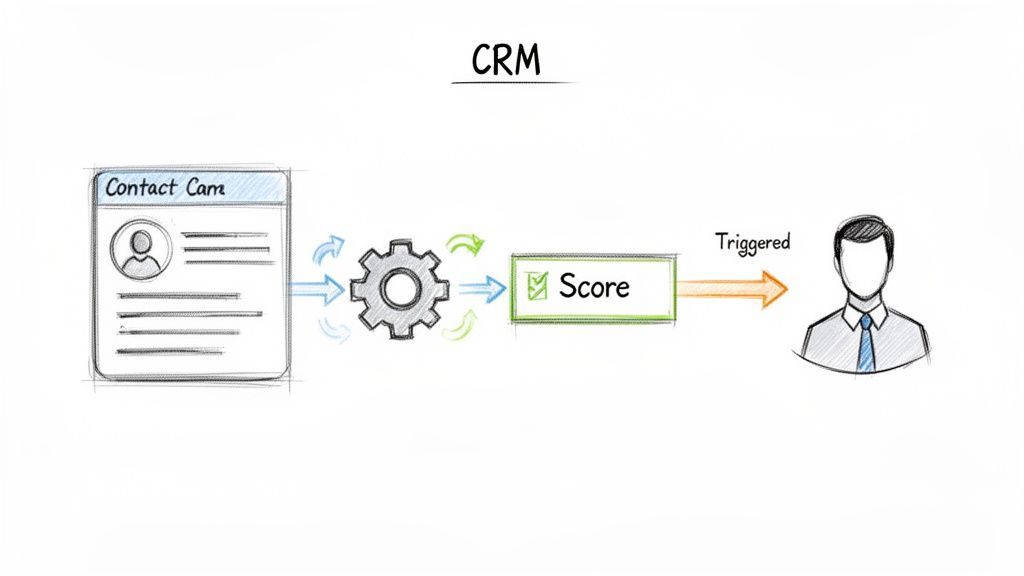

A well-designed lead scoring model on paper is just a plan. The real magic happens when you embed it directly into your CRM, letting it run automatically in the background to surface your best leads in real time. This is how you transform lead scoring from a theoretical exercise into a dynamic, hands-off engine for your sales team.

The goal is to set up a system where your CRM—whether it's HubSpot, Salesforce, or another platform—does all the heavy lifting for you. It involves a few key steps, but modern tools make the process surprisingly simple. When you're done, you'll have a system that instantly updates a lead's score the moment they take a meaningful action, like visiting your pricing page or requesting a demo.

Building the Technical Foundation

Setting up your lead scoring system inside a CRM follows a pretty logical path. While the exact button clicks might differ between platforms, the core ideas are the same everywhere. You're essentially building a living, breathing system that reacts instantly to new data and behavior.

Here’s how you get it done:

- Create Custom Score Properties: First things first, you need a place in your CRM to actually store the score. This is usually a custom numerical property you can name "Lead Score," "Interest Score," or "Fit Score." This new field becomes the scoreboard where all the points get tallied.

- Translate Your Model into Rules: Next, it's time to build the logic. Most modern CRMs have a workflow or automation builder where you'll translate your scoring model into a series of "if/then" rules. For example: "If a lead’s

Job Titlecontains ‘VP,’ then add 15 points to theirLead Score." - Automate Score Updates: You'll create a separate rule for every single attribute and behavior in your model. This includes rules for firmographic data like company size and industry, as well as behavioral triggers like email opens, page views, and form submissions. This is what makes the whole system fire on its own, no human intervention required.

Why Clean Data Is Everything

Here's the hard truth: an automated scoring system is only as smart as the data it's fed. If your CRM is a mess of incomplete, old, or just plain wrong information, your scores will be completely useless. This is the single biggest reason why lead scoring initiatives crash and burn. Garbage in, garbage out.

This is where data enrichment becomes non-negotiable. Enrichment tools automatically fill in the blanks and verify lead data, making sure the firmographic details your model relies on—like job title, company size, and industry—are correct from the second a lead enters your system.

Clean data isn't just a "nice-to-have"; it's the fuel for your entire lead scoring engine. Without it, your automation will just make bad decisions faster.

For teams using a tool like Add to CRM, this process is baked right into their workflow. A sales rep prospecting on a professional networking site or a manager working in HubSpot can capture a profile, enrich it with over 220 million professional data points, and verify the email with 96% accuracy. The contact lands in the CRM already scored against their model. This completely eliminates manual data entry, saving teams 4+ hours per week and ensuring every new lead fuels accurate scoring. You can discover more insights about the impact of enriched data on Crunchbase.

Tying It All Together for Your Sales Team

With solid automation built and clean data flowing in, your team can finally stop wasting time trying to qualify leads by hand. The CRM becomes the single source of truth, automatically flagging high-scoring leads and telling reps exactly who to call next.

This setup makes sophisticated lead scoring a realistic strategy for any company, not just massive enterprises. It takes the manual work out of the equation, freeing your reps to do what they do best: building relationships and closing deals with prospects who are genuinely ready to talk. If you're looking to get your tech stack in order, understanding the fundamentals of CRM integration software is a great place to start.

How to Measure and Refine Your Scoring Model

Getting a lead scoring model up and running is a huge win, but it’s the starting line, not the finish. The single biggest mistake you can make is treating it like a crockpot—set it, forget it, and hope for the best.

Your market changes. Your customers evolve. Your product gets new features. If your scoring model stays frozen in time, it will quickly become useless. Think of it as a living system that needs regular check-ups to stay in peak condition. A good model tells you which leads are warm; a great one gets smarter every single quarter.

Key Metrics to Track Model Performance

So, how do you know if your scoring system is actually working? You have to look past the scores themselves and measure their real-world impact on the business. These are the numbers that prove your high-scoring leads are actually turning into paying customers.

Your measurement dashboard should put these three metrics front and center:

- Lead-to-Opportunity Conversion Rate: This is the ultimate test. What percentage of your sales-qualified leads (SQLs) are actually turning into legitimate sales opportunities? If this number is low, it’s a giant red flag. Your threshold might be too low, or your criteria are out of sync with what sales truly values.

- Sales Cycle Length: Are high-scoring leads closing faster than low-scoring ones? They absolutely should be. If your “hot” leads are taking just as long to close as the ones in the bargain bin, your model isn’t doing a good job of flagging genuine purchase intent.

- Win Rate by Score: It's time to analyze your deals, both won and lost. What was the average score for your wins versus your losses? A healthy gap here is the proof in the pudding—it shows your model is successfully picking the leads most likely to become customers.

A healthy lead scoring model isn't just a filter; it's a predictor. The scores it generates should directly correlate with positive sales outcomes like higher win rates and shorter sales cycles.

Creating a Powerful Feedback Loop

Data tells you what is happening, but talking to your sales team tells you why. That qualitative feedback is pure gold, and you can’t get it from a dashboard. The best lead scoring systems are built on a rock-solid foundation of sales and marketing alignment.

Put a quarterly review on the calendar with sales and marketing leaders to dissect the model's performance. Pull up recent deals—wins and losses—and ask the tough questions. Did the scores accurately predict the outcomes?

Maybe sales noticed that leads who downloaded a specific case study are closing at a much higher rate than the model gives them credit for. Boom. That’s your signal to bump up the points for that action.

This feedback loop is what transforms your model from an educated guess into a fine-tuned, data-backed machine. When lead scoring first went mainstream after 2010, this alignment was its biggest benefit. Now, predictive models are pushing this even further, with teams that prioritize leads effectively seeing 22% higher quota attainment, according to findings on predictive analytics.

The Future of Scoring: AI and Predictive Models

If you look at where lead scoring is headed, all signs point to artificial intelligence. Instead of you manually tweaking points, predictive models use machine learning to do the heavy lifting. The AI analyzes all your historical data, finds the subtle traits of your best customers, and builds a model that improves itself over time.

It can analyze thousands of data points to spot patterns a human would never catch—like discovering that leads from a specific region who visit a certain blog post are 3x more likely to buy.

This technology is no longer just for massive enterprises. It’s becoming more accessible, allowing teams of all sizes to maintain an incredibly accurate and dynamic scoring system with a lot less manual effort. Of course, before you can predict a lead's future value, you need to understand its current worth. Our guide to calculating lead value can help you nail down that foundation.

Common Lead Scoring Mistakes and How to Avoid Them

Putting a lead scoring model in place is a huge step forward, but a few common tripwires can completely sabotage your efforts. Think of your model like a high-performance engine; even tiny miscalibrations will tank its performance. Dodging these predictable mistakes is the key to building a system that actually works.

One of the biggest blunders is trying to build a ridiculously complex model right out of the gate. Teams get excited and start tracking dozens of attributes, ending up with a scoring system so convoluted that it's impossible to manage or understand. The scores become just noise because nobody knows what they really mean.

The goal of lead scoring isn't to be perfectly complex; it's to be practically useful. A simple model that works is far better than a sophisticated one that gathers dust.

Another classic error is when marketing builds the model in a vacuum. Without deep, ongoing input from the sales team, the final product almost always misses the mark. This is how you end up with sales reps who completely ignore the scores—they don't trust them because they don't reflect what's actually happening on the front lines.

Starting Simple and Staying Aligned

The fix for over-complication is simple: start with just 5-10 core attributes. Pick the data points you know are strong indicators of a good lead, like job title, company size, or high-intent actions like requesting a demo. You can always add more complexity later once you have some real-world data to work with.

And to bridge the gap between sales and marketing, you have to make sales a co-owner of the model from day one.

- Host a kickoff workshop: Get both teams in a room to agree on a single definition of a "sales-ready lead."

- Review past deals: Dig into recent wins and losses together. What were the actual attributes that separated the good leads from the bad?

- Create a feedback loop: Set up quarterly meetings to go over the model’s performance and tweak it based on what the sales team is experiencing.

Keeping Your Data Fresh and Relevant

Finally, a lot of teams treat lead scoring as a one-and-done project. They build it, launch it, and never touch it again. The problem? Your data gets stale, fast. People switch jobs, companies get acquired, and their needs change. A model running on outdated information is going to give you unreliable scores, period.

This is where continuous data enrichment becomes non-negotiable. Your system needs a steady diet of accurate, up-to-date information to work correctly. This ensures your what is lead scoring model reflects today's reality, not last year's assumptions. By steering clear of these common mistakes—over-complication, siloed planning, and data neglect—you'll build a resilient system that consistently surfaces your best opportunities.

Common Questions About Lead Scoring

Once you start building out a lead scoring model, a few practical questions always seem to pop up. Let's clear up the common ones so you can move forward with confidence.

How Often Should I Update My Lead Scoring Model?

A good rule of thumb is to review your lead scoring model quarterly. This gives you enough time to gather meaningful data without letting the model get stale.

Get your sales team in a room and look at the last quarter's closed-won and closed-lost deals. Were the scores accurate predictors? If you notice high-scoring leads consistently ghosting you, or low-scoring leads turning into amazing customers, it’s time to tweak your point values.

What Is the Difference Between Lead Scoring and Lead Grading?

This one trips people up all the time, but it’s pretty simple when you break it down. They work together, but they measure two totally different things.

Lead Scoring answers the question, "How interested is this person in us right now?" It's all about their behavior and engagement—visiting the pricing page, downloading an ebook, etc. It's usually a number.

Lead Grading answers, "Is this the right type of customer for us?" This looks at who they are—their job title, company size, industry. It’s a measure of fit, usually represented by a letter grade like A, B, C, or D.

The magic happens when you combine them. A lead with an A grade and a high score is your top priority. That's a perfect-fit company that's actively showing buying signals.

Can a Small Business Use Lead Scoring Effectively?

Absolutely. You don't need a massive database to get started. Even small teams can benefit hugely from focusing their limited time on the right prospects.

Start simple. Build your initial model based on what you already know about your ideal customer and a few key actions that signal real intent, like filling out your contact form or requesting a demo. As you close more deals, you’ll gather more data to refine the model. Modern CRMs and enrichment tools have made this so accessible, you don't need a data science team to make it work.

Ready to build a smarter, faster lead qualification process? Add to CRM provides the one-click data capture and enrichment you need to fuel an accurate lead scoring model. Get started for free.

Start saving time and closing more deals.

Find contact info for your prospects on the #1 business social network and add them to your CRM with 1-click.

Trusted by 1000s of founders, SDRs & more